Main takeaways

MetaMetals commodity NFTs prioritize the underlying precious metals. Strong tokenomics and a fundamental change in the interpretation of assets makes it possible to put physicals and its holders into the center of attention.

Intro

Precious metal products have a price action on their own and they can be categorized as assets. For projects which distribute highly unique assets (in our case precious metals and precious metal crystals), new Web3- technologies raise some sincere question regarding funding methods. The following sections explain in detail why the tokenomics of commodity NFTs (cNFTs) is so unique and powerful.

Funding methods

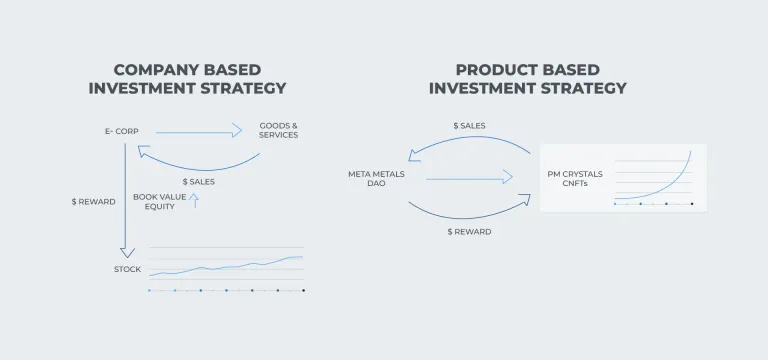

Let's imagine two different companies (here's a sketch) and call the first one E-corp for simplification. Like most companies in Web2, E-corp and its investors follow a company based investment strategy. They sell products and services which create revenue to improve their balance sheet. If we speak about a stock corporation, rational arguments state that a rising book value/equity should lead to a rising stock price. Also company issued dividends or stock buyback programs will have positive effects on the stock price. This creates an environment where investors might be more interested in a rising stock, than a working product and long term customer satisfaction.

For investors it's especially important to keep the balance between personal gains and the long term health of the company. Aggressive sales strategies and neglecting research and development, might have good short term effects on a companies results, however they can jeopardize a company over mid- and longterm (unsatisfied customers, sinking revenue, stronger competitors, etc.). Nevertheless company based investment strategies have become the holy grail in economy. To its defense, most companies don't offer products which fulfill investment characters.

At this point we can ask the question: What if a company would offer products which could be used as an investment, as it is with precious metals at MetaMetals? Why should the company set up a company based investment strategy in this case, just to reach profits for shareholders? It's a contradiction in itself. An explanation could probably only give the lack of technical possibilities to establish other forms in former decades. However, there are technical solutions to turn this strategy around to put the product into the center of attention.

Exactly, that's what is solved via a "product based investment strategy". A organization should prioritize the product and its holders. It's even possible to combine both via Web3 technology to make a holder of a product also part of the organization and vice verce. At MetaMetals we use commodity NFTs as the technology to do so. It's possible to couple RWA (Real World Assets) with blockchain technology. In our case real physical precious metals and crystallized precious metals can be bound to their digital counterpart onchain.

People familiar with Web3 might ask, why we don't set up a separate coin for this and make an ICO? The answer is clear and simple. We don't see any benefits of an additional coin which has similar issues as a "company based investment strategy". We could get quicker funding and set up a treasury, however we don't see additional benefits for precious metal holders, especially not if there are other technological solutions, like cNFTs. Furthermore blockchain users worldwide have seen enough of pump and dumps, rug pulls, projects with false promises awful design flaws and/or awful tokenomics or even founders draining ICO wallets. We clearly condemn such behaviour. MetaMetals has the chance to completely rethink these approaches and show the world that there are better tokenomic approaches.

Governance

Many Web3 protocols already have existing governance mechanisms based on their token (DAO - decentralized autonomous organisation). An approach which is hardly in use is a governance based on NFTs. In our case it's possible to set up governance mechanism based on the commodity NFTs traits. So a mechanism based on the real physical characteristics of the underlying asset can be used to generate a voting right.

For an example: A precious metal crystal has a weight of 100g. This number (100g) is extracted from the cNFTs metadata and multiplied with a key provided by the community (e.g. Osmium has a key of 10). Therefore a holder of a 100g Os crystal could be granted a voting right with 100*10 = 1000 votes.

Utility

NFTs as a technology also make it possible to be integrated in many more blockchain protocols and application. This brings more demand and utility to assets, especially to those with physical backing. Imagine an E-Sports team winning a MetaMetal cNFT as a price for a victory, or gamers finding rare precious metals in an online game which they can use for,building,trading etc. Bringing high utility to extremly scarce precious metals and precious metal products is high advantage in terms of Tokenomics.

DeFi

Integrating Metametals into DeFi (NFTFi) as assets in decentralized finance can give many benefits to blockchain protocols and MetaMetals holders. Holders may gain access to DeFi trading pools and their PMs could be considered as collateral on DeFi and NFT lending platforms.

There are already many great examples of how NFTs were used as collateral (loan for crypto punks, p2p nft lending on Blur). This shows that NFTs and even some NFTs with real world backing are already considered as collateral in many different protocols.

There are not many assets which would be more suitable for onchain collateral than precious metals. This could not only bring benefits to MetaMetals holders it could also lead to an increase of great collateral for DeFi lenders. Lenders have to calculate risk/reward in terms of interest rate and collateralization ratio. High quality precious metals in their lending portfolios could decrease their risk to stabilize their lending portfolios. How? Commodity NFTs have intrinsic value through their RWA coupling. Any decrease beneath acceptable prices would lead to massive arbitrage opportunities otherwise.

Gaming

Onchain gaming has been mentioned as a clear trend in the coming crypto cycles. There are games with a whole organization built around Web3 (e.g. Sandbox) and established gaming companies who've decided to experiment with NFTs in their ecosystems - the applications and number of gaming NFTs in this sector are raising daily. This opens up the door for NFT projects integrating their assets in games. What does this mean for MetaMetals? Real physical goods can be integrated via cNFTs in many applications which can generate additional real demand and utility for unique objects. Imagine a game where a rare Metametals NFT can be found in a treasure somewhere. This exact object could be sold, exchanged or used as raw material to craft a legendary sword or another rare object. Another application could be trophys for E-Sports.

Physical coverage

Commodity NFTs (redeemable onchain real world assets) have clear benefits compared to purely digital NFTs. Where others launch purely digital collections out of an automatic generator to mint a bunch of ~20k NFTs, MetaMetals can't do that. Our NFTs will be bound to their physical counterpart and only one, either the physical or the commodity NFT, can exist in a owners hand at a time. There will be an audited vault to securely store physical MetaMetals which serve as the backing for the digital NFT counterparts. Furthermore the physicals are extremly scarce precious metals and precious metals products. They offer an intrinsic value through nature. MetaMetals focuses on precious metals of the platinum group, if they're crystallized their level of scarcity can be increased even further.

Pay-Outs and Buy-Backs

A long term vision for giving additional tokenomic boost to MetaMetalsare mechanisms which are easily viable. A certain level of the treasury/income could be used for payouts to cNFT (commodity NFT) holders. Another way would be a buy-back program for crystals. This reminds of mechanism applied by Web2 companies. These mechanisms could be coupled with the governance as described above. An additional method could be NFT staking (better known as nesting, like introduced by "Moonbirds") or additional benefits vor voters. These steps and visions should underpin MetaMetals intentions: Our assets and its holders should benefit and not an intransparent Web2 construct.

Sources of income

- Ongoing sales of MetaMetals products

- Future product innovation and new developments (e.g. crystallized Rhodium, Iridium, etc.)

- MetaMetals as raw material for the luxury good industry (integration of crystallized precious metals into jewelry like osmium necklaces, for example)

- Using commodity NFTs: Royalities, storage fees and auctions

Branding

Metametals has a verified tradmark, which should help to build a brand. This is an additional benefit for holders.

FAQ

Here are a few questions which Web3 enthuasiasts might have. If your questions aren't answered, feel free to reach out to us.

- When DAO?

We'll share a roadmap. Creating a DAO based on physical assets, is a long lasting process. Community members are always welcome. Join our Discord to get in touch with us.

- When do commodity NFTs launch?

We'll release a roadmap for that. However the speed of our operation is limited. This could change quickly in case of increasing community engagement or sales. At the moment we're a developing a set of smart contract protoypes which will be shared soon.

- How can I join the project?

Simply join our Discord or write us. We're still in our early stages.

- How can I become a MetaMetals holder?

MetaMetals precious metals can be bought via our Webshop. They will be delivered to your prefered location. As soon as we launch our NFT plattform, you can send it in to be put in the vault. Your commodity NFT will be vault it for your commodity NFT.

- Is there a presale?

Yes, we're already selling physicals, which can be onboarded as cNFTs later. Physicals can be purchased in our webshop. Please consider that some products will get more advantages than others later.

- Are there egibility programs or airdrops for holders?

We're planning a lot of benefits for holders, as described above.

- Is there an ICO?

There won't be an ICO (see explanation in the section funding methods). Typical funding and investor structures are exchanged by cNFTs. We don't need another coin for that. As soon as our commodity NFTs are deployed and the vault structure is set, it will be possible to onboard physicals or buy cNFTs directly.

Disclaimer: These materials are for general information purposes only and are not investment advice or a recommendation or solicitation to buy, sell or hold any cryptoasset or to engage in any specific trading strategy. Some crypto products and markets are unregulated, and you may not be protected by government compensation and/or regulatory protection schemes.